Warning: This article contains mentions of suicide and suicidal ideation. Take care when reading.

Canadians are increasingly struggling with their mental health, a new report suggests, a concerning trend that appears in part to be driven by the economy and personal finances.

In the last year, about one in seven Canadians have thought about suicide, a poll from Mental Health Research Canada (MHRC) shows.

Among the concerns noted by the research group, suicide ideation is more predominant in younger people, and is particularly high among 16- and 17-year-olds, including other age groups like 18-to 34-year-olds.

Some of the main contributors to declining mental health are difficult financial situations, inflation, and housing and food security, the survey showed.

“Financial instability is impacting suicide ideation, with those experiencing money problems being more likely to have considered it,” the study published Wednesday reads. “Specifically, those who are unemployed (24 per cent), have an income below $30,000 (21 per cent), have financial troubles (41 per cent) or have gone into debt due to inflation (30 per cent) indicated having had suicidal thoughts in the past year.”

The survey polled 3,819 Canadians across the country from July 27 to Aug. 13, 2023. It is the 17th report of its kind from MHRC, which has tracked the mental health of Canadians since April 2020.

Previous editions noted a small improvement in the mental health of respondents when COVID-19 restrictions were lifted. Researchers anticipated the indicators would increase further, but instead, the most recent data suggests mental health is “flatlining.”

(MHRC)

(MHRC)

FINANCIAL CONCERNS A ‘MAJOR’ FACTOR

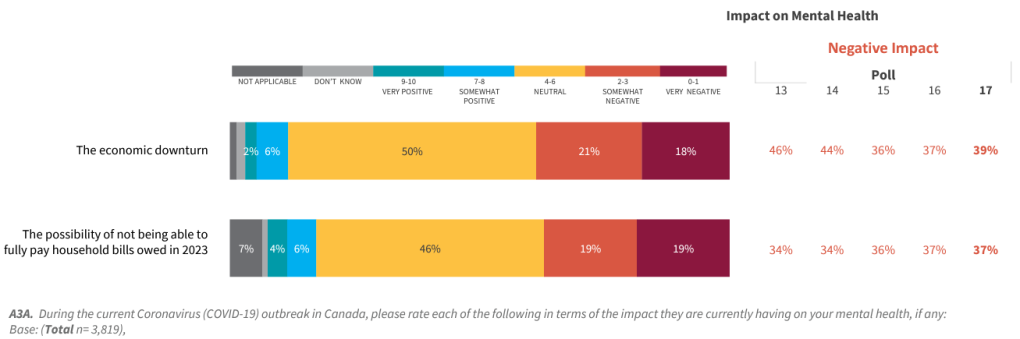

Poll 15 of this project uncovered the trend that a poor economy and inflation were negatively impacting Canadians.

Months later, in Poll 17, the data shows a similar trend line.

Almost 40 per cent of respondents said they feel the state of the economy is negatively impacting their mental health. Those with lower incomes were more likely to say they have high anxiety and depression, the study says.

In the past year, the Bank of Canada has been increasing interest rates in an effort to bring down inflation. This has negatively impacted many Canadians in both the rental and housing markets, who are now, or were already, struggling to afford the higher cost of living.

About 23 per cent of Canadians said they were concerned about paying for housing, Poll 17 shows, which is an increase of 3 per cent since the spring and 8 per cent more year-over-year.

Along with housing pressures, the rising rate of inflation means Canadians are paying much more for groceries, causing stress for many who worry whether their paycheque will cover the essentials.

“There has been no relief for those with food insecurities,” the study says.

Prior to the uncertain economic times, there were many people in Canada living in food insecurity, but since the pandemic and with recent rising costs, this number has increased exponentially in the past several years, based on the polling by MHRC.

About one-third of Canadians worry they cannot afford healthy food, the latest poll shows, and 3 per cent of respondents said they are dependent on food programs, such as food banks.

“Those experiencing high levels of anxiety or depression are significantly more likely to experience food insecurities,” the study reads.

Younger Canadians (aged 18 to 34), women, those who have children under nine, unemployed people, minorities and those with chronic pain are the most food insecure in Canada, according to the survey.

WHAT CANADIANS HAVE DONE TO COMBAT INFLATION

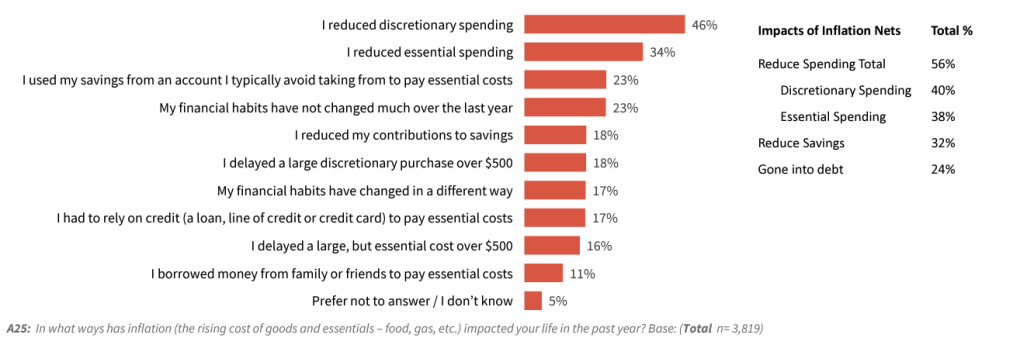

To combat higher costs of living, 25 per cent of respondents said they have gone into debt.

“Those who rate their anxiety and depression as very high are more likely to have gone into debt, as are those likely to have symptoms of a severe mental disorder and who have possible alcohol or cannabis dependency,” the study shows.

Inflation has impacted three-quarters of Canadians in the past year, a four per cent increase since the last poll a few months earlier.

To manage high costs, many people (46 per cent) are reducing discretionary spending or reducing essential spending (34 per cent).

About 23 per cent are using their savings to pay for essential costs and 17 per cent rely on a credit card or loans to pay for items. About 11 per cent say they borrowed money from friends or family to keep afloat.

As inflation continues to pinch the pockets of Canadians, the correlation between mental health is apparent, those behind the surveys say.

The polling suggests that 39 per cent of people have been negatively impacted by the economic downturn, and 37 per cent said they may not be able to pay all of their household bills in 2023.

(MHRC)

(MHRC)

CANADIANS KNOW WHERE TO GET SUPPORT BUT CAN’T AFFORD IT

Knowing the impacts of mental health, about 72 per cent of people said they are somewhat or very confident they know how to access support for themselves or loves ones.

This is an increase of 5 per cent from Poll 16 and a huge leap (17 per cent) from Poll 15.

“Those who have accessed mental health supports in the past year are more likely to feel very confident, (which is) consistent with Poll 16 findings,” the study says.

People with high anxiety are less confident in getting support but those with a diagnosis are more confident, the latest poll suggests.

Despite many Canadians knowing how to access support, about one in 10 people reported using mental health services in the last year.

One of the reasons for not accessing support is the financial burden, the study says.

“Of those who felt they needed mental health support but didn’t access it, almost one-in-three said they couldn’t afford to pay for it,” Poll 17 data shows. “This is an increase of 11 per cent from Poll 16 and 14 per cent from Poll 15.”

Other barriers include wait times, accessibility, a lack of confidence in the health care system and no coverage through benefits.

An increasing number of Canadians (39 per cent) reported they are paying out of pocket due to a lack of coverage. This has increased 9 per cent since Poll 16.

——

If you or someone you know is in crisis, here are some resources that are available.

Canada Suicide Prevention Helpline (1-833-456-4566)

Centre for Addiction and Mental Health (1 800 463-2338)

Crisis Services Canada (1-833-456-4566 or text 45645)

Kids Help Phone (1-800-668-6868)

If you need immediate assistance call 911 or go to the nearest hospital.