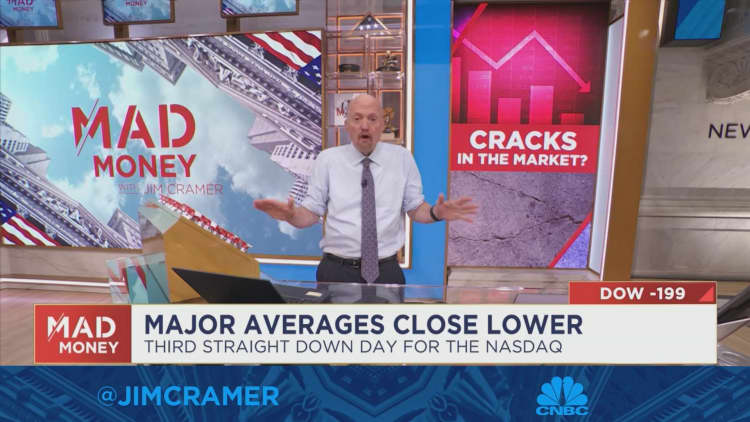

CNBC’s Jim Cramer told investors he sees “cracks” in the market, especially in the prospective earnings of some big name companies.

He stressed that many of these cracks may be due to the time of year, with September being a historically down month for the market. Cramer added that the rising price of oil is having a negative impact on many stocks.

By Wednesday’s close, the Dow Jones Industrial Average fell 198.78 points, or 0.57%, to 34,443.19. The S&P 500 dropped 0.7% to 4,465.48, while the Nasdaq Composite declined 1.06% to 13,872.47.

“The real crack we saw today and what we saw yesterday is why I hate September. Too much goes wrong,” Cramer explained. “The good news? We’re already down that much, so maybe we’ll start running out of downside soon, assuming the cracks in this market don’t keep getting bigger.”

Cramer noted cracks in the retail industry, highlighting the recent success of TJX, the parent company of TJ Maxx and Marshalls. When TJX does well, Cramer said, it may mean that many other retailers are struggling because the company takes unwanted or excess inventory from other companies and sells it at a discount. He also noted the sudden departure of Walgreens’ CEO, Roz Brewer, which Cramer said can’t be positive for the company.

Cramer stressed the cracks he sees in the auto industry, with the three leading U.S. carmakers potentially facing a strike.

“The unions have a strike fund, which lasts a heck of a lot shorter than the pots of gold the auto companies have saved,” Cramer said. “But the auto companies have been pumping out as much product as possible in case we do have a strike, which means they’re going to get hurt either way.”