If you want to know how quickly electric vehicles might spread across the U.S., just look at California. In the past five years, EVs have gone from 2% of new-car sales in the state to 22%.

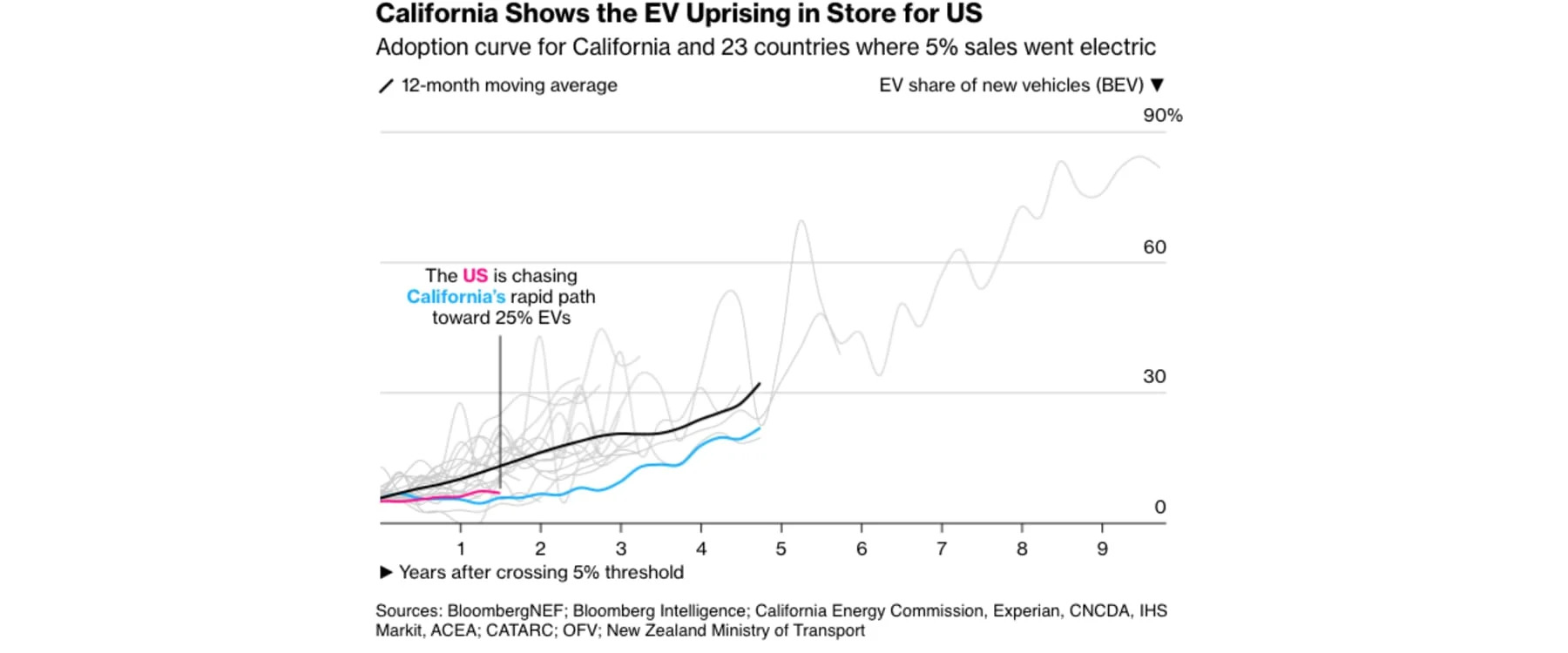

The pace of adoption in California picked up significantly once EVs reached 5% of new-car sales, a threshold at which preferences start to flip for mainstream car buyers, according to a Bloomberg Green analysis of EV adoption curves around the world. California was one of the first major car markets to reach that tipping point, in 2018, and so far 23 countries have been added to the list.

If California were itself a country, it would now rank fourth in terms of overall EV sales; only China, the US and Germany sell more. The pace of adoption in the state shows no signs of slowing, either, with second-quarter EV sales rising 70% over the same period in 2022. The US as a whole is just three years behind California, and currently tracing its path. If the trend continues, a quarter of new car sales could be electric by 2026.

For all good technologies, there comes a point at which sticking with the old tech no longer makes sense. Think smartphones in the 21st century or color TVs in the 1960s. Sales move at a crawl in the early-adopter phase, then surprisingly quickly once things go mainstream.

Alarm bells for automakers

Figuring out when EVs will shift into mass-adoption mode is proving an existential challenge for the automotive industry. The transition requires hundreds of billions in capital investments, made years ahead of widespread demand. Investing too soon could squander fortunes on undesired vehicles, while moving too slow risks ceding the market to early movers like Tesla.

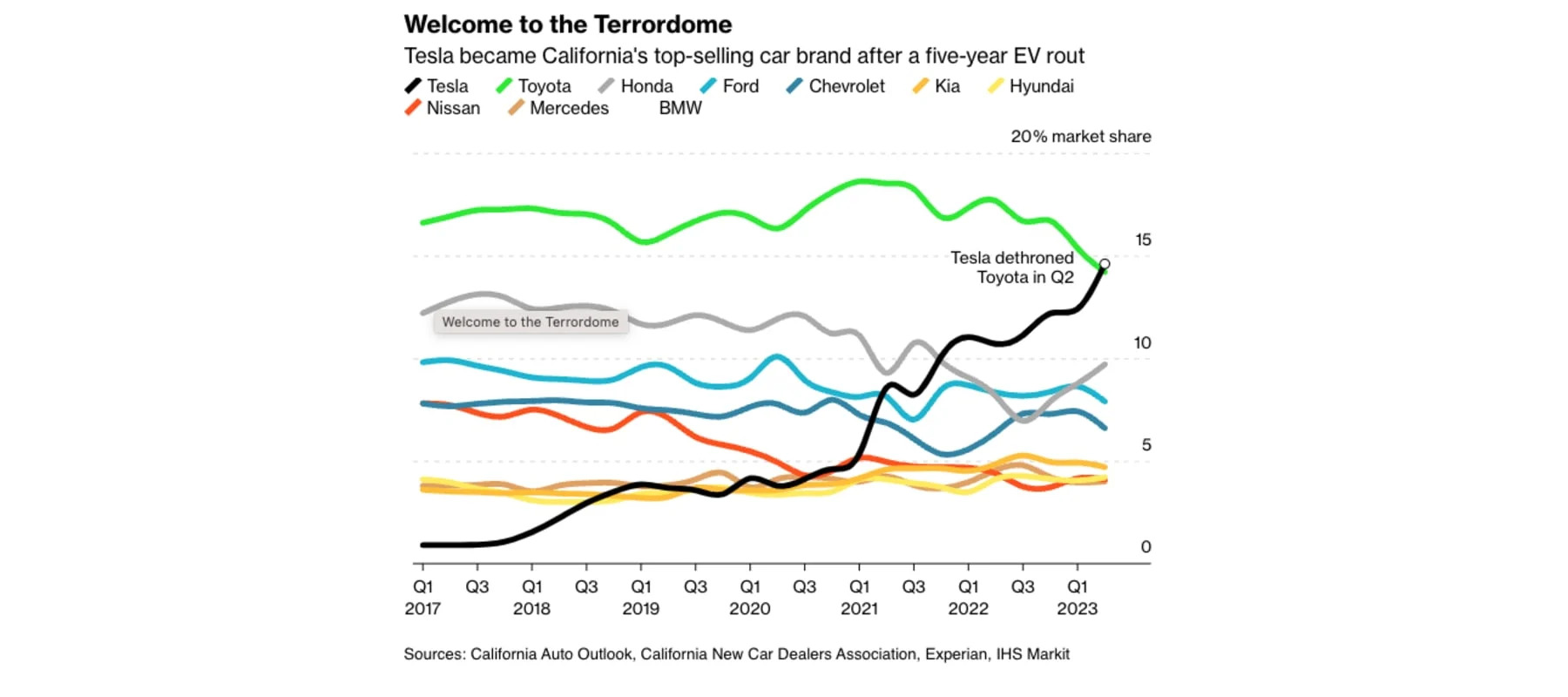

In a milestone that should be setting off alarm bells for traditional manufacturers, Tesla recently overtook Toyota as the top-selling car brand in California.

The first global automaker to reach mass EV scale, Tesla controls 60% of the US EV market. It spent this year dropping prices and adding new features while maintaining industry-leading margins. Outside of China, car companies have yet to produce a single EV that approaches the sales volumes of Tesla’s Model 3 or Model Y. Until that kind of scale is achieved, the transition will continue to be a costly grind.

At traditional US dealerships, meanwhile, inventories of unsold EVs have been rising. But increasing competition shouldn’t be mistaken for diminishing demand. More than half of US consumers think EVs are the future, according to a recent survey by Cox Automotive, and their expectations are rising around what that future should include. Expensive, low-range EVs that might have been successful five years ago are no longer cutting it. Some customers are also holding out for new models from America’s iconic brands — Chevy’s Silverado and Blazer, for example — or for the newly refreshed Model 3 or Tesla’s much-awaited Cybertruck.

Until 2020, EV sales in California were largely determined by how many copies of a single vehicle, the Model 3, a single Tesla factory could produce. The US EV market is not so fragile anymore. Some $200 billion is being spent on 100 US factories for electric vehicles and the batteries that power them. It could be the biggest industrial build-up in US automotive history.

EV adoption is accelerating pretty much everywhere. Even in India, home to the cheapest cars in the world, battery-powered models are starting to make inroads. Automakers that can’t figure out how to make money on electric options soon are likely to fall further behind those that already have. But to see where things are headed next in the US, it’s worth keeping an eye on the roads in California.

Related Video: